Contents

1 Introduction

The aim of this policy is to:

- provide guidance and advice to managers and colleagues on the termination of fixed term contracts

- provide guidance on the trusts approach to the retirement of colleagues in line with the Equality Act 2010

- detail the arrangements in relation to notice periods, where a colleague chooses to end their employment with he trust or where the trust terminates an colleague’s contract.

- support the trust to be an employer of choice and as such value the views and experiences of all colleagues. The trust therefore recognises the need to conduct exit interviews with all colleagues who leave the organisation. The benefit to the trust of encouraging staff to complete exit interviews is that important information can be obtained which can be used to support other initiatives and policies such as health and well-being, stress management and equality. Information can also be used to inform and plan recruitment and retention, workforce development and shape how the trust motivates staff

2 Purpose

The policy covers four distinct policy areas. The purpose for each area is detailed below:

2.1 Fixed term contacts

To facilitate an understanding to the circumstances and approach for terminating a fixed term contract be applicable when an employee is leaving employment.

Guidance for managers to ensure consistent and fair treatment of staff on fixed term contracts in accordance with the fixed term employees (prevention of less favourable treatment) Regulations 2002.

2.2 Retirement guidance

Guidance that sets out the trust’s approach to the retirement of colleagues, in line with the Equality Act 2010.

2.3 Notice periods

Written guidance on the provision of notice periods and to establish a framework for notice periods. It recognises that particular roles will require a longer period of notice if a replacement is to be sought and to minimise the impact of the employee’s departure.

2.4 Exit interview

- Identify areas of good practice which can then be promoted and built upon.

- Analyse and monitor to inform recruitment, retention and turnover activities.

- Gain constructive feedback relating to any negative aspects of a leaver’s employment to ensure that steps can be taken to minimise future occurrences.

- Display openness and integrity by providing all colleagues leaving the trust the opportunity to provide feedback.

3 Scope

This policy and procedure applies to all colleagues within the trust.

An exit interview will be offered and an exit questionnaire will be issued to all staff leaving the employment of the trust. The questionnaire will be issued to staff leaving as a result of the cessation of temporary or fixed term contracts as well as permanent contracts but is not relevant for internal job changes or promotions.

4 Responsibilities, accountabilities and duties

4.1 All directors

All care group directors have a responsibility to ensure that the policy is consistently applied across their area of responsibility.

4.2 Deputy care group directors, service managers, or heads of corporate service

All corporate heads of service or deputy care group directors or service managers must ensure the policy is consistently applied in the termination of fixed term colleagues and when staff are leaving employment within their area of responsibility.

4.3 Line managers or appointing officers

Managers must ensure that each element of this policy and procedure is implemented consistently by ensuring that:

- all colleagues are aware of this policy and procedure and how to access it

- ensure documentation is completed appropriately and forwarded in a timely manner to pay services

- ensure compliance with the procedural section of this policy

4.4 Colleagues

It is the responsibility of each employee to comply with the procedural sections of this policy who wishes to resign from their employment.

4.5 Human resources department

It is the responsibility of the human resources department to support and advise managers and colleagues in the application of this Policy and procedure, ensuring consistency is applied.

5 Procedure or implementation

5.1 Fixed term contracts

5.1.1 Termination of fixed term contracts

The following process should be used when a fixed term contract is being terminated and the non-renewal of the fixed term contract is for the reason set out at the time the fixed term contract was offered.

5.1.1.1 Procedure to be followed

When a fixed term contract is coming to an end, the appointing officer or line manager will arrange a formal meeting with the employee, to be chaired by the deputy care group director (or equivalent, who has the authority to dismiss in accordance with the trusts policy and procedure for the management of disciplinary matters, schedule of delegation).

The employee has the right to be accompanied by a companion. The chosen companion may be a fellow trust employee, or a trade union representative. The purpose of the meeting is to review the fixed term contract of employment and confirm whether the contract will cease in accordance with the employee’s notice period.

The meeting needs to be scheduled to allow the employee sufficient time to be served with their appropriate notice after the meeting, therefore in accordance with the notice periods schedule in section 7 of this policy.

If a colleague is entitled to a greater statutory notice period given their length of service, then the formal meeting must be scheduled in accordance with this time period and not the band notice period, the employee is afforded the longest notice period, either statutory or contractual (section 7.2 and 7.3). Where the fixed term contract is offered for the same duration as the colleagues notice period then advice should be sought from human resources as to how to manage this situation.

Whilst a colleague will generally be informed of the outcome at the conclusion of the meeting, it must also be confirmed in writing, usually within seven calendar days of the meeting. Consideration must be given to the requirement of the safe haven policy, how to store, transfer and communicate person-identifiable, confidential and sensitive information, section 5.5 for the correct labelling of letter.

Colleagues will be advised at the meeting and in the letter confirming the outcome of their right to appeal and will be given details of to whom any appeals should be addressed. It is the responsibility of the manager chairing the meeting to ensure that this letter is sent.

Appeals must be lodged in writing by the employee or their companion within 21 calendar days of the date of the letter confirming the outcome and the grounds for the appeal which must be outlined in full.

The format and nature of the appeal hearing will be consistent with appeal hearings as detailed in the policy and procedure for the management of disciplinary matters.

5.1.3 Termination of fixed term contracts on other grounds

Human resources should be contacted in the first instance if the following apply:

- if the reason for the expiry or non-renewal of the contract is different to the reason that the contract was established, or the last reason (in case of a succession of fixed term contracts) as to why the contract was varied on a fixed term arrangement

- if a fixed term contract needs to end before the end date specified in the contract of employment for instance as a result of either a conduct or change management issue. As either course of action would require the application of other trust procedures, namely the disciplinary policy or the change management policy and procedure

Managers must deal with cases of poor performance, misconduct, capability, sickness and any other employment relations issues under the appropriate trust policy and procedure and not under this policy.

5.1.4 Exceptions to normal termination process for a fixed term contract

In certain circumstances it may not be appropriate to terminate a fixed term contract at its end date, for example, if the employee is pregnant. In these circumstances please refer to the relevant policy, for example, the family leave policy. Where this is the case Line managers should contact human resources in the first instance for further guidance.

5.1.5 Colleagues with more than 2 years NHS continuous service

Colleagues with more than 2 years NHS continuous service at the time of the termination of their fixed term contract may be entitled to redundancy.

If a colleague is employed in a post for a fixed period to complete a project or temporary role that is no longer required and the employee has more than 2 years’ service, the dismissal may be by reason of redundancy. In those cases, the trust’s change management policy and Procedure may apply and managers must contact human resources if they consider that these circumstances apply prior to any decisions being made and communicated to the affected employee.

5.1.6 NHS continuous service, effect on redundancy claims

Colleagues who are appointed on a fixed term contract for less than 2 years, but have continuous NHS service from another NHS trust or organisation which exceeds a total of 2 years at the point at which the fixed term contract would cease, may be eligible for a redundancy payment at the end of the fixed term contract, if the definition of redundancy is met.

Existing colleagues who transfer to a fixed term position retain all rights as a permanent employee including the right to redundancy as linked to continuous NHS service. Where this is proposed or envisaged advice must be sought from human resources prior to any agreements being reached.

5.2 Retirement guidance

The trust recognises the contribution that a diverse workforce can bring, with a wealth of skills and experience, regardless of age. It believes that colleagues should, wherever possible, be permitted to continue working for as long as they are able and wish to do so.

Compulsory retirement at any age is unlawful. As such, the trust does not operate a default retirement age.

5.2.1 Retirement planning

In order to support workforce planning, human resources will send out details to the deputy care group director of all staff who are 50 and over, thus providing a list of those staff who may potentially wish to retire. The list will be sent to each deputy care group director on an annual basis, normally as part of the workforce planning cycle. Age 50 is used as this is the minimum pension age for the 1995 scheme for voluntary early retirement.

As part of the annual performance development review, Line Managers will discuss with a colleague objectives and development plans for the forthcoming year. As part of this process the employee may identify that they are considering retirement and or accessing their pension at which point the manager should identify the potential retirement date and any details in relation to possible flexible retirement and assist with appropriate documentation.

As there is no default retirement age, it is important to note that it would not be appropriate or lawful for the manager to ask the employee if they are planning to retire. Colleagues must feel able to continue to work without feeling under pressure to retire.

Details of any pre-retirement or financial planning courses or seminars will be publicised throughout the trust so that any staff considering retirement can attend to assist with planning for their future.

5.2.2 Information for colleagues

All members of the pension scheme from:

- the age of 55 for special class and mental health officer (MHO) status (see definition below)

- 60 for all others in the 1995 scheme

- 65 in the 2008 scheme

- state pensionable age in the 2015 scheme

Can retire on a full pension depending on pay, length of pensionable service or time in the scheme, and whether employed full or part-time. Any other pension schemes where colleagues have transferred under TUPE to the trust guidance should be sought from the Pay Services team.

All members may take voluntary early retirement and receive pension benefits from age 50 (those in the 1995 scheme pre 6th April 2006) or age 55 (2008 and 2015 scheme), subject to approval from the NHS pensions agency. Benefits will be worked out in the normal way, but will be reduced on a sliding scale dependent upon age (this is called the “actuarial reduction”).

Additional options available from April 2023 are for colleagues to retire gradually, and work flexibly for longer thereby enabling them to continue to work and to pass on their skills and knowledge to colleagues. Options available are as follows, as changes are expected also in October 2023 please contact the pension officer (pay services) regarding your plans.

ERRBO, early Retirement reduction buy-out.

This option is available to members of the 2015 pension only who can buy out the reduction that would apply if they claimed their NHS pension before normal pension age. In the 2015 scheme, this is age 65 or the same as state pension age if that is later. Normal pension age may rise during membership of the scheme if the state pension age rises.

More information can be found at the NHSBA early retirement (opens in new window).

As pension requirements are subject to change, colleagues wishing to retire early under the terms of the NHS pension scheme should contact the Pay Services team for further information before giving formal notice of their intention to retire.

For colleagues who retire before scheme age (for example, retire early) the pension benefits due will be reduced in accordance with the terms of the NHS pension scheme. For nurses, midwives, health visitors, physiotherapists in post before 6 March 1995 (collectively described as ‘special class status’ this only applies to members in the 1995 scheme who meet the criteria) and mental health officers in post before 6 March 1995 have the right to retire from a normal pension age of 55 without a reduction to their pension, subject to certain criteria being met, this can be accessed via the total reward statement (TRS) available on the electronic staff record (ESR).

5.2.2.1 Step down

Staff may step down to a different role, for example, to reduce the level of responsibility while remaining in NHS employment. This helps the staff member change the intensity of work while supporting the organisation in retaining valuable skills and experience. Some members opting to step down may be eligible to have their higher level of pensionable pay protected, which might mean that their final salary benefits are not affected.

5.2.2.2 Wind down

Reducing working hours while staying in the same role. For members of the 2015 pension this will reduce pensionable pay and a lower pension in the 2015 scheme will result compared to working full-time. For members of the 1995 or 2008 schemes any final salary benefits earned will continue to be based on whole-time equivalent pensionable pay and protected from changes in working patterns.

5.2.2.3 Partial retirement or draw down

Members over age 55 can take part, or all their pension benefits and continue in NHS employment. They may continue to build up further benefits in the 2015 Scheme if they wish.

In order to do this, the pension member’s pensionable pay must be reduced by at least 10 per cent for at least a year, or the member will cease to be eligible for the pension they have drawn down. They can ‘draw down’ on up to two occasions before retiring completely, however if the benefits are paid before normal pension age, the benefits would be reduced as they are being paid early.

Partial retirement is available to staff in the 2008 section and 2015 scheme of the NHS pension scheme. It will be available for staff in the 1995 section from 1 October 2023.

5.2.2.4 Retire and return

Staff who have reached the minimum pension age may leave NHS employment, claim their pension benefits and later decide to return to NHS employment. Staff have the option to join the 2015 Scheme on returning to work in the NHS, if they wish. It must be noted that

5.2.2.5 Pension Scheme retirement flexibilities, a summary of eligibility

Flexibility: 1995.

- Step down: Yes.

- Wind down: Yes.

- Retire and return: Yes.

- Draw down: From 01 October 2023.

- Late retirement enhancement: Yes.

- ERRBO: Yes.

Flexibility: 2008 section.

- Step down: Yes.

- Wind down: Yes.

- Retire and return: Yes.

- Draw down: No.

- Late retirement enhancement: Yes.

- ERRBO: Yes.

Flexibility: 2015 scheme.

- Step down: Yes.

- Wind down: Yes.

- Retire and return: Yes.

- Draw down: No.

- Late retirement enhancement: No.

- ERRBO: Yes.

Taken from NHS employers website (opens in new window).

Further details on any of the above may be obtained from pay services or from the NHS pensions website at NHSBA pension website (opens in new window). Any colleague wishing to retire and access their pension is advised to contact pay services for information following notification to their manager and must provide at least 4 months notification to the Pay Services team officer in order to ensure the relevant forms can be processed in a timely manner.

5.2.3 Information for colleagues who wish to continue to work but are planning to access their pension

A colleague may decide that they do not wish to retire but still wish to access their pension.

If this situation arises, a colleague must apply using the flexible retirement form (appendix A) to their line manager within at least five months of their intended retirement date. The line manager in consultation with the head of department will consider each request taking into account individual circumstances and service needs and provide a response to the request in writing within 14 days of receipt of the request. The request may be refused if any of the following grounds apply:

- burden of additional costs

- detrimental effect on ability to meet service needs

- inability to re-organise work among existing staff

- inability to recruit additional staff to meet the parameters of the request

- detrimental impact on quality or performance

- insufficiency of work during the periods the employee proposes to work

- planned structural changes

- detrimental effect on ability to meet patients or clients or service user demand

If the line manager is unable to approve a request in an environment where a number of colleagues are already working flexibly and any further flexible working arrangements will impact adversely upon the trust, the line manager may consider calling for volunteers from existing flexible working colleagues to change their working hours if they are willing to do so thereby potentially creating capacity for granting new requests to work flexibly (there would be no expectation that existing colleagues must agree to this however).

Alternatively, the line manager may explore within their area of work or directorate any vacancies which may facilitate the flexible retirement application and share these with the employee.

Should a colleague wish to appeal against the decision, they must notify their manager within 14 calendar days of being notified in writing of the outcome, stating the grounds for their appeal.

The appeal will be conducted by a manager at deputy care group director level or above, and will follow the same format as a grievance hearing. The decision of the manager at appeal stage is final and there is no further right of appeal.

If the request is agreed, then the flexible retirement form will be authorised by the deputy care group director and forwarded to the pay services department at least four months prior to the date of the flexible retirement. Managers are reminded of the requirement to also submit a termination and new starter documentation to payroll in a timely manner.

In order to access their pension and continue in their NHS employment with the trust, colleagues MUST first take at least a 24 hour break from employment. The requirement to work no more than 16 hours per week for members of the 1995 scheme no longer applies and remains not applicable for members of other schemes.

In accordance with agenda for change terms and conditions the 24 hour break constitutes a break in service for pension purposes, ie that occupational or enhanced redundancy would not be paid to anyone who has service that has previously been used to calculate NHS NHS pension benefits. The break in service does not affect a colleague’s annual leave or sickness absence entitlement or entitlement to statutory redundancy.

Colleagues wishing to access their pension and apply to continue working may do so without restriction on their pension upon reaching the pensionable age for the pension scheme. However if under 60 (1995 scheme) or 65 (2008 scheme) while abatement to pension has been suspended, partial retirement requires staff to reduce their pensionable pay by at least 10% for the first year. For further details see notes for pensioners and their dependents, booklet R. on the NHS pensions website

If this restriction does not apply, after the first month following access to the pension, the employee may, if the application to the trust to continue to work is successful, continue to work their previously contracted hours.

5.2.4 Retirement procedure

Colleagues intending to retire must give a minimum of 3 months’ written notice of their intended retirement date. Whilst this may be longer than the contractual notice period and not a requirement of the employment contract, this enables the necessary pension arrangements to be made and for the required replacement to be recruited in good time. When a member of the NHS pension scheme is intending to retire, their line manager should advise the employee to contact the Pay Services team at least 5 months prior to the proposed date of retirement.

If a colleague is retiring and not continuing their employment with the trust, the line manager must complete a termination form and send to the pay services department in a timely fashion but no later than the payroll cut-off date for the month the employee retires.

If a colleague is retiring and it has been agreed by the trust that they will be returning to work in their existing contracted role or an alternative role, then the line manager must complete part 2 of the flexible retirement form (appendix A) and the partial retirement checklist form if applicable and send to the pay services department in a timely fashion. Applications for flexible retirement to the pensions agency will only be submitted by pay services once the flexible retirement form (which has been signed by the employee, Line manager and deputy care group director) has been received within the pay services department and also the partial retirement checklist form where relevant.

A colleague may decide that they do not wish to retire from their post but wishes to be considered for alternative working arrangements. Any request to do so should be submitted via the flexible working policy.

5.2.5 Retirement presentation and long service award

The trust would wish to recognise the service of those colleagues who retire after completing long service both within the trust and the NHS.

Staff that have completed 10 or more years’ reckonable service will receive a retirement certificate. The retirement certificates should be obtained by the manager from the communications department.

Colleagues who have completed a period of service with the trust or any other NHS employer will be eligible to receive on retirement a long service award:

- 20 years or more: Long service award £100

- 30 years or more: Long service award £125

- 40 years or more: Long service award £150

The retirement gift will take the form of vouchers or e-vouchers which will be funded from the appropriate line manager’s budget. The vouchers or e-vouchers can be ordered through the purchasing department. Gifts can be paid in circumstances where a staff member retires, or is retired early for health reasons, and provided that the eligibility period has been met, to the next of kin when a colleague dies during employment.

A retirement presentation should be organised for all staff leaving who are retiring from all employment with the trust.

The line manager will be responsible for organising the event or presentation, which should be of a style appropriate to the NHS, the length of NHS service and acceptable to the retiree. The line manager should involve the team in the organisation of the event, which should be held on trust premises.

The appropriate line manager will authorise from their budget a contribution of up to £100 towards the cost of the event which may include a buffet, flowers, etc.

5.2.6 Colleagues experiencing ill health and sickness absence

Colleagues who are absent because of ill-health for a protracted period, or experiencing significant ill-health may be involved in discussions in accordance with the trust’s sickness policy. Please refer to the trust’s sickness policy.

Further information regarding Ill Health Retirement has been released by NHS pensions, If a colleague becomes too ill to work, they may be able to retire and take pension benefits.

To be eligible for ill health retirement, they will need to have:

- been a member for a minimum 2 years

- not reached normal pension age

- become too ill to work in their present job

This must be the decision of the individual employee. Information can be sought from NHS pensions. Additionally, while still in employment, the trust’s occupational health advisors can be approached to give an opinion as to whether an application for ill health retirement may be supported. Applications for ill health retirement can be made at any point prior to the termination of contract.

- Ill health retirement benefits webpage for members (opens in new window).

- Member guide for ill health retirement (opens in new window).

- Employer checklist for ill health applications (opens in new window).

5.3 Notice periods

5.3.1 Procedure or implementation

5.3.2 Statutory notice periods

Under the provision of the Employment Rights Act 1996, there are statutory rights of notice which an employer must provide to a colleague dependent upon the length of service.

The minimum statutory provisions are:

- one week’s notice if the period of employment is less than two years

- one week’s notice for each year of continuous employment if the period of continuous employment is two years or more but less than twelve years

- twelve weeks’ notice if the period of continuous employment is twelve years or more

5.3.3 Trust notice periods

The trust has a contractual minimum period of notice as set out in the schedule below, which is adopted within employee’s contracts of employment:

- band 1, notice required by either side, four weeks

- band 2 to 4, notice required by either side, four weeks

- band 5 to 7, notice required by either side, eight weeks

- band 8 and 9, notice required by either side, twelve weeks

- consultants and specialty doctors, notice required by either side, three months

- executive directors, notice required by either side, six months from August 2020. Three months’ notice for appointees prior to this date

- CEO, notice required by either side, six months

Where a colleague is subject to a probationary period employment may be terminated by either the employee or the trust giving two weeks’ notice in writing.

Colleagues must provide the trust with their notice of resignation in writing; the trust does not accept verbal resignations. Upon resigning, the employee is expected to work their full contractual notice period, as defined in the trust notice periods above, unless otherwise explicitly agreed and confirmed in writing by the appointing officer or line manager.

Colleagues are responsible for ensuring that the line ,anger or appointing officers receives their resignation letter in good time. A colleague’s notice period will commence from the date the letter is received within the trust.

5.3.4 Rights and obligations during the notice period

During the notice period, the contract of employment will continue to remain in force and the employee will receive full pay and benefits.

During the notice period, the employee remains bound by all the obligations and restrictions expressly set out or implied in their contract of employment. The trust expects that the employee will conduct themselves in an entirely appropriate manner during the full period of notice, and uphold the standards of performance required of all colleagues. This applies regardless of which party gave notice to terminate the contract of employment and for whatever reason.

If a colleague’s performance during the notice period falls below the required standards, the trust may address this as a performance or disciplinary matter and may refer to this in any references provided on the employee’s behalf. For further information and guidance refer to the management of performance (capability) policy and procedure and the policy and procedure for the management of disciplinary matters.

During the notice period, the trust may restrict a colleague’s duties, contact with clients or service users, colleagues and suppliers, access to information or resources and impose any other reasonable practices, to better facilitate a handover and or to protect the trust’s interests.

5.3.5 Action by line managers or appointing officers upon receipt of a resignation letter

The appointing officer or line manager must acknowledge in writing the receipt of the letter. A template letter is provided at appendix C. The letter also includes arranging an exit interview with the employee. Please refer to section 8 of this policy for further information.

The appointing officer or line manager must complete and submit a termination form to the payroll department as soon as the final date of employment is agreed, ensuring that where possible all annual leave entitlement has been taken before the final date of employment. In some circumstances it may be preferable for a colleague to be paid for any outstanding leave and this should be clearly stated on the termination form.

The appointing officer or line manager should ensure that on the last working day, the employee returns all trust equipment or property and terminate access to all systems.

Once a colleague has submitted their resignation or notice, which has been acknowledged in writing by the trust (refer to appendix B) there is no automatic right for the employee to rescind their notice. If the employee wishes to rescind their notice, it is at the appointing officers or line managers discretion, in consultation with HR, whether they allow the notice to be rescinded.

5.3.6 Trust property

If the employee fails to return any property belonging to the trust by the required date, the last day of employment, the trust will withhold the whole or any part of any pay due from the trust to the employee up to the current market value of the property not returned, for example, based on the value of the property at the time that it is not returned and not on a replacement cost basis. The trust may also issue civil proceedings against the employee for breach of contract and or trespass to goods, to the extent that any outstanding pay withheld does not cover the current market value of the property not returned.

If the employee has a lease car the employee must liaise with the travel department to ensure that the vehicle is returned prior to their final date of employment.

If the employee has resigned they are liable for any early termination fees associated with the return of the lease car.

5.3.7 Pay in lieu of notice

The trust may make a payment in lieu of notice for all or any part of a colleague’s notice period on termination of their employment (rather than the employee working their notice period). This provision, which is at the trust’s discretion, applies whether notice to terminate the contract is given by the employee or by the trust.

5.3.8 Annual leave during notice periods

Colleagues who leave employment will be entitled to their annual leave entitlement for each part worked and full month worked in the current year on a pro-rata basis.

During the notice period, the trust requires colleagues to take annual leave accrued for that holiday year but not taken by the date of termination, wherever possible.

If, prior to notice of termination being given by either party, the trust has authorised a colleague’s annual leave request, and the annual leave is scheduled to take place during the notice period, the trust will seek to honour this arrangement. However in exceptional circumstances, the trust may, if necessary for business reasons, require the employee to cancel all or part of their annual leave, on giving the appropriate notice.

If, on termination of a colleague’s employment, the employee has accrued annual leave that they have not taken, they will be paid in lieu of this as part of their final salary.

If, on termination of a colleague’s employment, the employee has taken paid holiday leave in excess of the earned entitlement, they will be required to reimburse the trust (by means of deduction from salary) in respect of such holiday.

5.3.9 Outstanding payments to the trust

The trust may deduct from any final salary all monies owing to the trust. (In addition please refer to section 7.6, trust property)

If a colleague fails to work their full contractual notice period without prior authorisation from the appointing officer or line manager, the employee will not be paid for the portion of the notice period that they have not worked. The trust may also reflect this in any reference given on the employee’s behalf.

If the employee’s final pay is insufficient to cover the sums owed to the trust, the employee will enter into a contract with the trust for the repayment of all sums owed. If the employee refuses to do this, or defaults on any repayment agreement, the trust may bring a civil claim against the employee to recover the monies (as a debt) and its costs of doing so.

5.3.10 Outstanding payments to the employee

A colleague who wishes to claim expenses incurred in the course of their duties must do so before the end of their notice period. The employee must follow the procedure set out in the trusts approval of use of private vehicles for business purposes and claiming of expenses policy. If the employee has not followed the procedure set out in the policy, the trust may not repay the expenses to the employee.

5.3.11 Termination of employment by the trust

5.3.11.1 Ill health

Where a colleague is dismissed on the grounds of incapability due to ill health, they are entitled to a period of notice on the termination of their contract. This period will not be less than the statutory minimum period of notice. For further information refer to the trust’s sickness policy.

5.3.11.2 Dismissal, gross misconduct, or summary dismissal

Where the trust dismisses a colleague, it will give the employee his or her full contractual or statutory notice. However, colleagues who are summarily dismissed from the trust will not be entitled to payment in lieu of notice. For further information refer to the disciplinary policy.

In certain circumstances, including dismissals for gross misconduct, the trust may dismiss the employee without notice. If this is the case, the trust will explain the reason(s) why.

5.3.11.3 Redundancy

Where the trust dismisses a colleague by reason of redundancy, the trust will provide the employee with their full contractual or statutory notice and will require the employee to work the full period of notice. For further information refer to the trust’s change management Policy.

5.4 Exit interview

5.4.1 Procedure or implementation

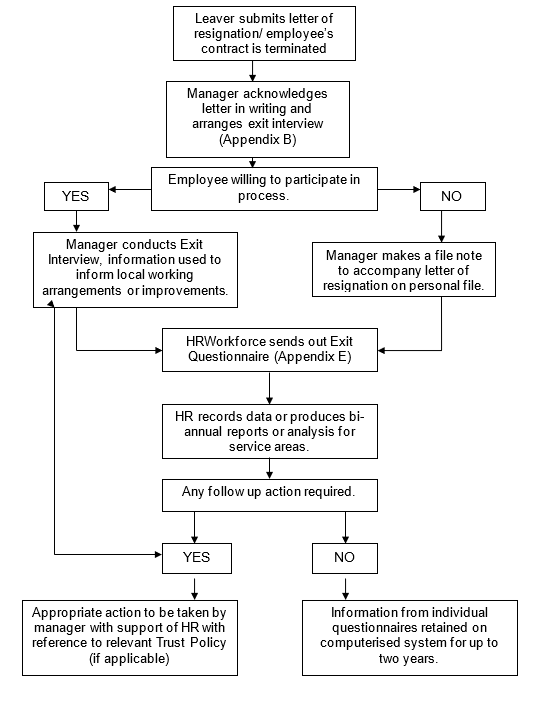

(Refer to appendix B, exit interview or questionnaire flowchart)

On receipt of a letter of resignation, the manager will offer the member of staff an opportunity of attending an exit interview. The exit interview should be conducted by the employee’s line manager, however if either party does not feel comfortable with this arrangement, the interview may be conducted by another appropriate manager or with a human resources representative.

If a colleague does not wish to attend an exit interview, they should be encouraged to complete the exit questionnaire and return it to the human resources department. Where the leaver declines to participate in either process, the manager should make a written note to accompany their letter of resignation. The HR Workforce team will send a link to an exit interview survey in order to facilitate an online response.

Additionally the pastoral support office will send a form and invitation to meet if the employee wishes to access a conversation with someone other than their line manager.

5.4.1.1 Guidance for managers conducting an exit interview

The manager will:

- acknowledge receipt of the letter of resignation in writing and arrange an exit interview on a mutually convenient date, and at a suitable time and venue (see appendix C, example letter for manager)

- at the outset of the interview explain:

- the purpose of the interview

- remind the staff member that all information will be treated sensitively and in confidence. There may be some circumstances where it may be necessary to disclose information which is discussed during an exit interview, these are explained in section 8.1.2

- how the information will be used

- that in analysis, the information will be anonymised

- during the interview:

- discuss the main reason(s) for leaving the trust

- record relevant comments objectively

- accept the views of the employee and at no time argue or disagree with the colleagues comments

- discuss the leavers overall experience of working for the trust

- discuss all trust documentation or property that needs to be returned prior to leaving (for example, mobile phones, laptops, ID cards, keys or security fobs and clinical equipment.)

- on conclusion of the interview:

- thank the employee for their time and co-operation

- explain that HR will be sending out an exit questionnaire

- encourage employee to complete exit questionnaire

- remind the employee that information will be anonymised and will help to inform and hopefully improve future working practices

5.4.1.2 When issues of concern are raised during an exit interview

There may be occasions when issues of concern are raised during an exit interview, for example, where a colleague alleges they have been bullied or harassed by another employee and or manager.

In these circumstances, the leaver will be asked if they have previously raised their concerns in an official capacity, for example if they have sought advice from human resources or made a complaint informally or through the appropriate policy mechanisms about the individual concerned.

If the employee has not taken any previous action(s) the interviewer will make the member of staff aware that they may ask for their concerns to be investigated.

If the employee does not wish to take the action outlined above, they will be asked if they agree to the interviewer discussing the concerns on their behalf with the relevant parties.

If the concern is of a serious nature, the employee should be advised that it should be formally investigated and as such they are required to provide further information. In these circumstances it may not be possible to retain information in absolute confidence and the employee should be advised how best they may be supported.

5.4.1.3 Exit questionnaire

The human resources department will run a monthly leavers report and send a link to the colleague for them to complete the exit questionnaire online.

If any staff do not have access to a computer or find it difficult to complete the online questionnaire they can request a paper copy of the exit questionnaire (appendix E) from the human resources department.

Analysis of the information sourced from the exit questionnaire will be carried out by the human resources department, giving breakdowns of leavers by staffing group, reasons for leaving and where colleagues are moving to if applicable. This information will be reported via the people sub-committee and planning group on a six-monthly basis.

If an issue of immediate concern is raised via an exit questionnaire, The human resources department will liaise with the care group director or deputy care group director to consider whether any further actions or considerations need to be undertaken.

Exit questionnaires will be retained for two years and then destroyed. Details held on the computerised system will be subject to the Data Protection Act 1998.

6 Training implications

There are no specific training needs in relation to this policy, but the following staff will need to be familiar with its contents:

- board of directors

- accountable directors

- service managers or corporate heads of service or deputy care groups

- line managers

- human resources staff

As a trust policy, all staff need to be aware of the key points that the policy covers. Staff should be made aware of the new policy and any subsequent revisions through:

- weekly bulletin

- daily communications

- line manager

7 Monitoring arrangements

Area for monitoring: Number of colleagues who are approaching the end of their fixed term contract of employment.

- How: An audit of the Electronic staff records system.

- Who by: HR managers.

- Reported to: Care group directors or deputy care group directors or corporate heads of service or corporate directors.

- Frequency: Quarterly.

Area for monitoring: Number of colleagues who are approaching four years’ service on a fixed term contract.

- How: An audit of the electronic staff records system.

- Who by: HR managers.

- Reported to: Care group directors or deputy care group directors or corporate heads of service or corporate directors.

- Frequency: Bi-Annually.

Area for monitoring: Colleagues approaching possible retirement age.

- How: Review of HR data.

- Who by: HR.

- Reported to: Director for people and OD.

- Frequency: Annually.

Area for monitoring: Requests for flexible retirement.

- How: Review of request forms.

- Who by: HR.

- Reported to: Director for people and OD.

- Frequency: Annually.

Area for monitoring: Responses from exit questionnaires.

- How: Analysis of staff group, reasons for leaving and destination.

- Who by: Human resources manager.

- Reported to: Director for people and OD.

- Frequency: Quarterly.

Area for monitoring: Record of exit interviews offered or undertaken

- How: Audit of sample personal files.

- Who by: Human resources or deputy care group director or service manager.

- Reported to: Director for people and OD.

- Frequency: Annually.

8 Equality impact assessment screening

To access the equality impact assessment for this policy, please see the overarching equality impact assessment.

8.1. Privacy, dignity and respect

The NHS Constitution states that all patients should feel that their privacy and dignity are respected while they are in hospital. High Quality Care for All (2008), Lord Darzi’s review of the NHS, identifies the need to organise care around the individual, ‘not just clinically but in terms of dignity and respect’.

As a consequence, the trust is required to articulate its intent to deliver care with privacy and dignity that treats all service users with respect. Therefore, all procedural documents will be considered, if relevant, to reflect the requirement to treat everyone with privacy, dignity and respect, (when appropriate this should also include how same sex accommodation is provided).

8.1.1 How this will be met

No issues have been identified in relation to this policy.

8.2 Mental Capacity Act

Central to any aspect of care delivered to adults and young people aged 16 years or over will be the consideration of the individuals capacity to participate in the decision making process. Consequently, no intervention should be carried out without either the individual’s informed consent, or the powers included in a legal framework, or by order of the court.

Therefore, the trust is required to make sure that all staff working with individuals who use our service are familiar with the provisions within the Mental Capacity Act (2005). For this reason all procedural documents will be considered, if relevant to reflect the provisions of the Mental Capacity Act (2005) to ensure that the rights of individual are protected and they are supported to make their own decisions where possible and that any decisions made on their behalf when they lack capacity are made in their best interests and least restrictive of their rights and freedoms.

8.2.1 How this will be met

All individuals involved in the implementation of this policy should do so in accordance with the guiding principles of the Mental Capacity Act (2005) (section 1).

9 Links to any other associated documents

- Change management policy and procedure

- Disciplinary policy

- Performance capability management policy and procedure

- Special leave policy

- Family leave policy (maternity, shared parental leave, adoption, paternity and nursing mothers)

- Sickness absence policy

10 References

- Employment Rights Act 1996 (Part IX and Schedule 8).

- Equality Act 2010.

- NHS Pension Scheme.

- Data Protection Act 1998.

11 Appendices

11.1 Appendix A Flexible retirement form

11.2 Appendix B Exit interview flowchart

- Leaver submits letter of resignation or employee’s contract is terminated.

- Manager acknowledges letter in writing and arranges exit interview (appendix B).

- Employee willing to participate in process.

- Yes, manager conducts exit interview, information.

- yes, appropriate action to be taken by manager with support of HR with reference to relevant trust policy (if applicable). End process

- no, HR workforce sends out exit questionnaire (appendix E)

- HR records data or produces bi-annual reports or analysis for service areas

- any follow up action required?

- yes, appropriate action to be taken by manager with support of HR with reference to relevant trust policy (if applicable). End process

- no, Information from individual questionnaires retained on computerised system for up to two years. End process

- No, manager makes a file note accompany letter of resignation on personal file.

- HR workforce sends out exit questionnaire (appendix E)

- HR records data or produces bi-annual reports or analysis for service areas.

- Any follow up action required?

-

- yes, appropriate action to be taken by manager with support of HR with reference to relevant trust policy (if applicable). End process

- no, information from individual questionnaires retained on computerised system for up to two years. End process

-

11.3 Appendix C Resignation acknowledgement letter

11.3 Appendix D Exit questionnaire

11.4 Appendix E Pension drawdown eligibility checklist

11.5 Further pension guidance, NHS pension update from 01 October 2023

11.5.1 NHS pension update

From 1 October 2023, the department of health and social care (DHSC) is introducing changes to make it simpler to take partial retirement, meaning you can claim your pension and work in a more flexible way without having to leave your job.

Taking part of your pension benefits is also sometimes known as ‘draw down’.

This is already possible for pension benefits you’ve earned in the 2008 section or 2015 scheme. From 1 October 2023, it will also include any 1995 section benefits you have.

From age 55 you’ll be able to take from 20% up to 100% of all your pension benefits in one or two drawdown payments, without having to leave your current job.

Members of the 1995 section who have a protected minimum pension age of 50 will also be able to claim pension benefits without leaving their job. To do this between the ages of 50 and 55, you’ll need to take 100% of your pension benefits. From age 55, you’ll be able take from 20% up to 100% of your benefits in one or two payments, without having to leave work.

You’ll be able to continue building your pension in the 2015 scheme. You won’t need to take a break or change jobs. You can carry on working if you want. You just need to reduce your pensionable pay by 10%. GPs, non-GP providers, and dental practitioners need to reduce their NHS commitments by 10%.

11.5.2 Am I eligible for partial retirement

To be eligible for partial retirement you must:

- be an active member of the NHS pension scheme

- have reached minimum pension age for each section of the scheme

- have a change in terms and conditions of employment following the reduction in pensionable pay

- expect the new level of pensionable pay to last at least 12 months from the point partial retirement is taken

- not already claimed partial retirement on two occasions

11.5.3 When will I be able to apply

There’s no rush to submit your application for partial retirement, take some time to find the right work and pension balance for you.

You need to consider what new working arrangements will work for both you and your employer, to enable you to reduce your pensionable pay by at least 10% for the first 12 months after taking partial retirement.

This could include, changing responsibilities, working fewer contracted hours, or moving to a role that requires less from you. You could also look at other types of working patterns you could do, that are not pensionable, such as overtime above full-time hours.

11.5.4 How do I know if partial retirement is right for me

From 1 October 2023 NHS pensions are releasing a partial retirement calculator for members to utilise to undertake their own forecast to help decide what percentage of pension to take.

You will also be required to reduce your pensionable pay by 10%. Pensionable pay must stay at the reduced level for 12 months after partial retirement or you will no longer be eligible for the pension you have taken.

11.5.5 How do I apply for partial retirement

You need to fill in the new flexible retirement approval form specifying that you wish to undertake partial retirement and you are going to reduce your pay by 10%. Once your manager has authorised the partial retirement a signed copy of the form needs forwarding via email too the below address

Upon receipt of the for pay services will forward onto you the form AW8 and the partial retirement supplementary form to you to complete.

Your manager will need to send a change notification via manger self-serve (MSS) on the day that you wish to access your pension advising pay services of the change to your working conditions to enact through pay.

11.5.5.1 Will the McCloud ruling affect partial retirement

As part of the McCloud ruling, affected members are due to have their pensionable service for the McCloud remedy period, 01 April 2015 to 31 March 2022 put back into he 1995 or 2008 section of the scheme on 01 October 2023 automatically.

Please be aware that the service transferred automatically back in will not be reflected on the upcoming TRS statements. The updates are scheduled to appear on next year’s statement in August 2024.

Affected members will be contacted in the 12 months after they’ve partially retired and asked to choose between keeping these benefits in the 1995 or 2008 section, or taking 2015 benefits for the remedy period, instead.

The choice means that there are other factors to consider for members deciding what percentage of their pension to take at partial retirement, as this could affect your tax position, or your final salary link.

If you choose later to transfer benefits for 1 April 2015 to 31 March 2023 back into the 2015 section potentially you may have overpayments to repay back.

There is an interim calculator that you can utilise from 1 August 2023, if you do not wish to wait until 1 October 2023 for the rollout for the fully functional partial retirement calculator (opens in new window).

To use the calculator, you will need to know pensionable service which is detailed on your TRS statement.

If you are a fully protected member (for example, transferred over to 2015 section in April 2023) you can use the percentage from this tool to estimate partial retirement benefits.

If you are not a fully protected member, you will need to request an estimate for partial retirement (opens in new window). And send to pensionscanquery@nhsbsa.nhs.uk.

11.5.6 Is retire and return still an option

Yes, there is still an option for you to choose to retire and have a day’s break or up to a month and return. If you choose this option, there is no requirement to take a reduction in your hours. There is a link below that has a wealth of information and factsheets for you to digest so you can make an informed decision that’s right for you.

Please visit the NHSBA re-employment (opens in new window) for more information about retire and return.

The flexible approval form will still need completing and sending to rdash.pensions@nhs.net and a member of the Pay Services team will then send out the relevant forms and next steps.

Your manager will need to complete a termination notification and new starter notification via manager self-serve (MSS) to notify pay services to enact changes through payroll.

Document control

- Version: 3.1.

- Unique reference number: 446.

- Approved by: Corporate policy approval group.

- Date approved: 8 January 2024.

- Name of originator or author: HR advisor.

- Name of responsible individual: Director for people and organisational development.

- Date issued: 9 January 2024.

- Review date: 30 November 2026.

- Target audience: All colleagues of the trust.

Page last reviewed: April 30, 2024

Next review due: April 30, 2025